nassau county income tax rate

164 rows Nassau County. If you would like more information and are interested in learning more about what tax advantages may be applicable to your business please call our office at 904-225-8878.

Mortgage Rates Hit Another Record Low But Homes Are Still Less Affordable Mortgage Rates Home Buying Mortgage

UFIFAS Callahan Extension Filing Sites.

. Municipality and school district Class code Enhanced. Verified insured clients surveyed for satisfaction. We welcome feedback on ways to improve the sites accessibility.

I support the Nassau County Legislative Majoritys call to stop Albanys proposed law S4264A A6967 which will increase taxes on gasoline and products to heat our homes. Town of North Hempstead. The steep NYC Income Tax surcharge in addition to Fedeal and NY State income taxes is also why some New Yorkers are tempted to cheat a.

3 discount if paid in the month of December. How to Challenge Your Assessment. You can use the New York property tax map to the left to compare Nassau Countys property tax to other counties in New York.

Nassau County property tax rate is one of the highest in New York state but if you are 65 or older you may be eligible for a Nassau County senior citizen property exemption. What are the taxes in Nassau County. CONTACT MEG MCALPINE 904570-5713.

Nassau County Senior Citizen Property ExemptionA Complete Guide. I am adamantly opposed to the proposed law which will raise gas taxes 55 cents and add roughly 825 to the average tank of gas. The US average is 46.

Full amount if paid in the month of March no discount applied. 4 discount if paid in the month of November. This site can file your 2020 Income Taxes in a Three-Step.

INCOME TAXES FILED AT NO CHARGE. Here are some of the important tax exemptions you should know about if you own a home in Nassau County. The TOP 10 Tax Preparers in Nassau County by The Prime Buyers Report.

Personal Tax Income State None Nassau CountyMunicipalities None Sources. - Purchases of tangible personal property made in other states by persons or. Assessment Challenge Forms Instructions.

Visit Nassau County Property Appraisers or Nassau County Taxes for more information. Sales and Use Tax State 6 imposed upon the list below. Tax Rates for Nassau County The Income Tax Rate for Nassau County is 65.

NYCs income tax surcharge is based on where you live not where you work. Answer 1 of 4. - Tax Rates can.

543350 US Highway 1 Callahan Florida 32011. The Nassau County Tax Collector is committed to an ongoing process of providing accessible content to all website visitors. Does Nassau County have income tax.

6 sales and use tax applies to. The average yearly property tax paid by Nassau County residents amounts to about 826 of their yearly income. I had paid a NYC Commuter Tax until 1999 now good riddance.

Enterprise Florida back to top. Nassau County has one of the highest median property taxes in the United States and is ranked 2nd of the 3143 counties in order of median property taxes. 86028 Pages Dairy Road Yulee Florida 32097.

Nassau County is ranked 4th of the 3143 counties for property taxes as a percentage of median income. What is the tax rate in Nassau County. The Nassau County Sales Tax is collected by the merchant on all qualifying sales made.

New York has a 4 sales tax and Nassau County collects an additional 425 so the minimum sales tax rate in Nassau County is 825 not including any city or special district taxes. Other municipal offices include. Five Nassau County men were arraigned Tuesday on state tax evasion-related charges with authorities saying they failed to file taxes for years withholding nearly 365000 in tax revenue and.

Nassau County New York sales tax rate details The Nassau County sales tax rate is 425. Tax Rates for Nassau County The Income Tax Rate for Nassau County is 65. MUST SCHEDULE APPOINTMENT.

2 discount if paid in the month of January. 30 rows - The Income Tax Rate for Nassau County is 65. The Nassau County New York sales tax is 863 consisting of 400 New York state sales tax and 463 Nassau County local sales taxesThe local sales tax consists of a 425 county sales tax and a 038 special district sales tax used to fund transportation districts local attractions etc.

This guide will help you understand the purpose of property tax exemptions and show you how to lower property taxes with the help of. Exemptions can help reduce your taxes often by a considerable margin. The Nassau County Department of Assessment establishes values for land and improvements as the basis for property taxes.

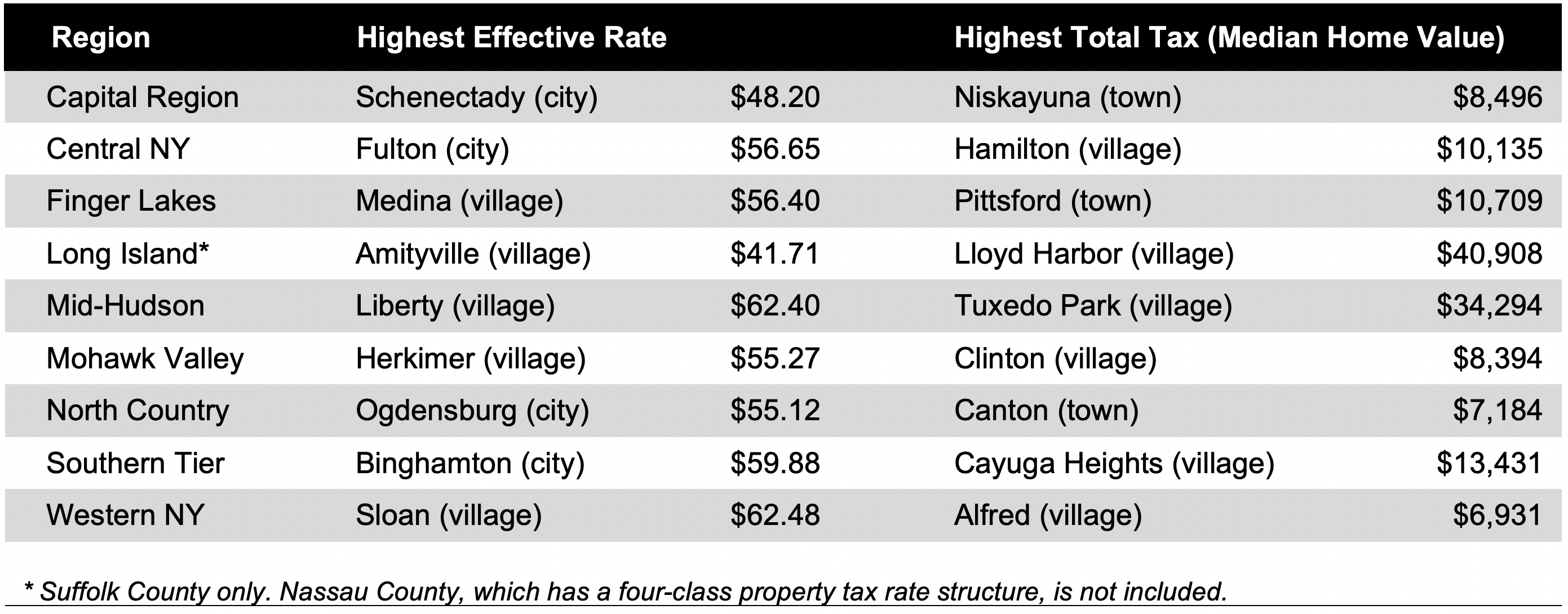

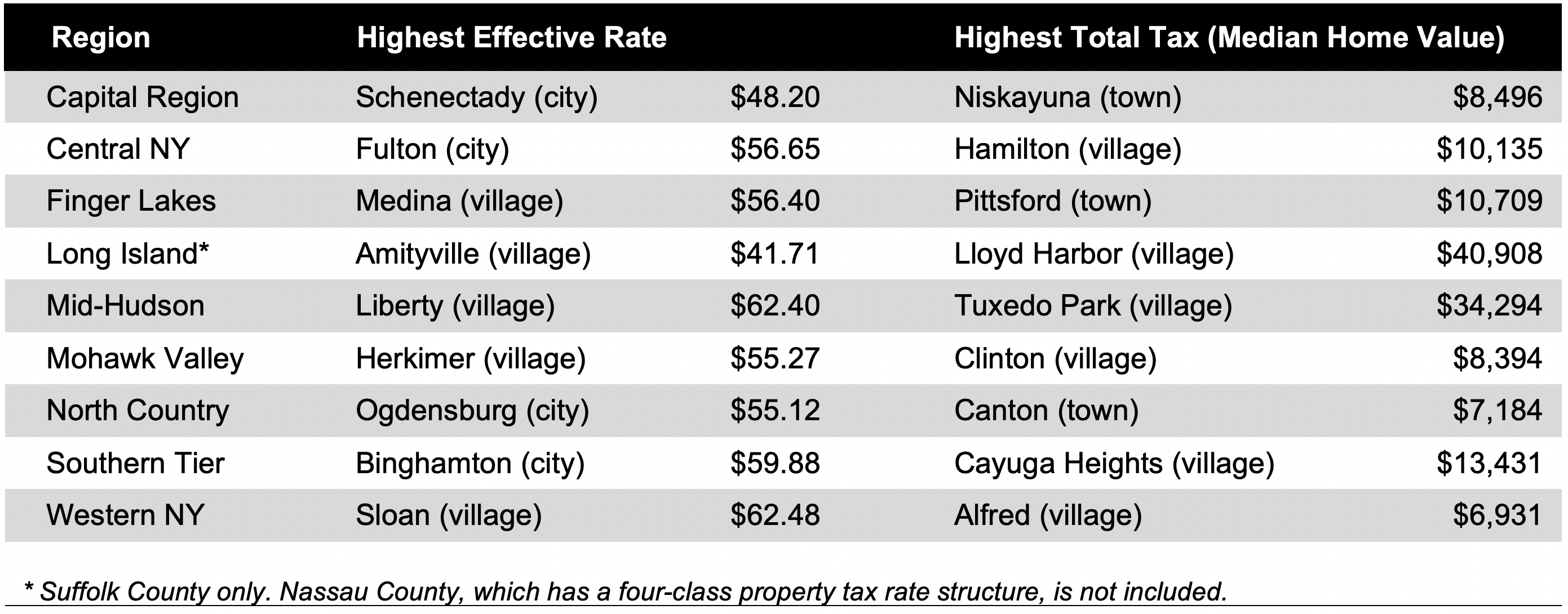

The lowest effective tax rate in the state was 393 per 1000 levied on homes and businesses in the Sagaponack school district portion of the Suffolk County town of Southampton. I support the Nassau County Legislative Majoritys call to stop Albanys proposed law S4264A A6967 which will increase taxes on gasoline and products to heat our homes. You can visit their website for more information at Nassau County Property Appraiser.

Nassau County Florida offers low corporate income taxes and no state income taxes. Town of Hempstead Receiver of Taxes. Nassau County property taxes are assessed based upon location within the county.

I am adamantly opposed to the proposed law which will 1 raise gas taxes 55 cents to 9812 cents per gallon which will make New Yorks gas tax 57 higher than the state. Does Nassau County have income tax. Rules of Procedure PDF Information for Property Owners.

Nassau County Tax Lien Sale. What town has the lowest taxes on Long Island. Nassau County 1 local option.

UFIFAS NASSAU COUNTY EXTENSION SERVICE. 1 discount if paid in the month of February. There are exemptions for veterans senior citizens volunteer firefighterambulance workers or people with limited income and disabilities.

The Us Supreme Court Held Railroad Company Stock Options Were Not Taxable Taxable Or Not Stock Options Are A Useful Too Family Law Wage Garnishment Irs Taxes

Homebuyer Sentiment Sinks To A 10 Year Low Amid Tight Supply Yahoo Finance Refinance Mortgage Real Estate Salesperson Mortgage

Our Numbers Speak Results Elliman Dominates The Long Island Market In Closed Units Grateful To Our Customers Clients Whose The Unit Nassau County Dominant

Reasons Why You Should Have Solar Roofing Infographic Educational Infographic Renewable Sources Of Energy Infographic

Cpa For Freelancers And The Self Employed In Nyc Small Business Cpa Manhattan Cpa Self Employed Nyc Cpa William Income Tax Income Tax Return Tax Services

1 25 Million Homes In Maine Texas And New York Maine House 1871 House House Prices

Pin By Adelphi Career Center On Employer Partnerships Public School Employment Opportunities Private School

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Free Congratulations From The White House The White House Greetings Office Room 39 1600 P Girl Scout Gold Award Letter Of Congratulations Girl Scout Leader

How To File Previous Year Taxes Online Priortax Online Taxes Previous Year Tax

Accounting Images Forensic Accounting Forensics

What S The New York State Income Tax Rate Credit Karma Tax

Bankruptcy Attorney New York Nassau Suffolk County Of Long Island Accounting Firms Accounting Services Tax Season

Purchase Your Next Investment Property At Auction With An Ira Investing Investment Property Real Estate Marketing

Labor Law Attorneys In Nassau County Labor Law Attorney At Law Nassau County